Optimizing App Flow

& Educating new

peer-to-peer

investors

Optimizing App Flow & Educating new peer-to-peer investors

Timeline

Timeline

5 WEEKS

5 WEEKS

Responsibility

Responsibility

UI/UX DESIGNER

UI/UX DESIGNER

Tools

Tools

Figma, Maze, Whimsical, Illustrator

Figma, Maze, Whimsical, Illustrator

Type

Type

iOS App

iOS App

Project Overview

Project Overview

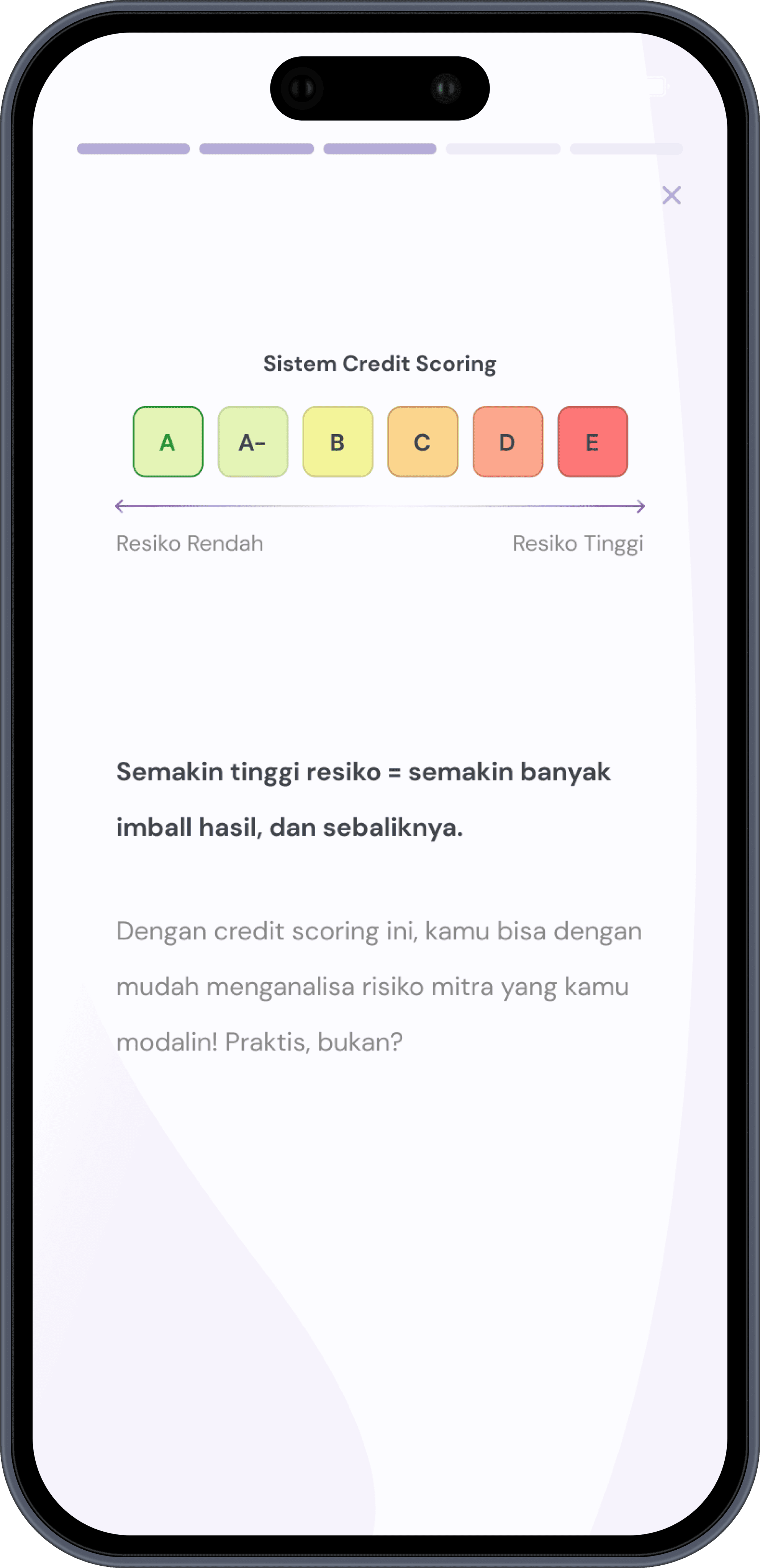

Amartha is a Peer-to-Peer Lending (P2PL) instrument offering Crowdfunding & Full investment system for Investors.

Their borrowers are mainly SMEs/UMKM, from local stores to local farmers. What's more, to help lenders select their potential borrowers, Amartha provides a credit scoring system based

on the borrower’s in running their businesses.

Amartha is a Peer-to-Peer Lending (P2PL) instrument offering Crowdfunding & Full investment system for Investors. Their borrowers are mainly SMEs/UMKM, from local stores to local farmers. What's more, to help lenders select their potential borrowers, Amartha provides a credit scoring system based on the borrower’s in running their businesses.

Amartha is a Peer-to-Peer Lending (P2PL) instrument offering Crowdfunding & Full investment system for Investors. Their borrowers are mainly SMEs/UMKM, from local stores to local farmers. What's more, to help lenders select their potential borrowers, Amartha provides a credit scoring system based on the borrower’s in running their businesses.

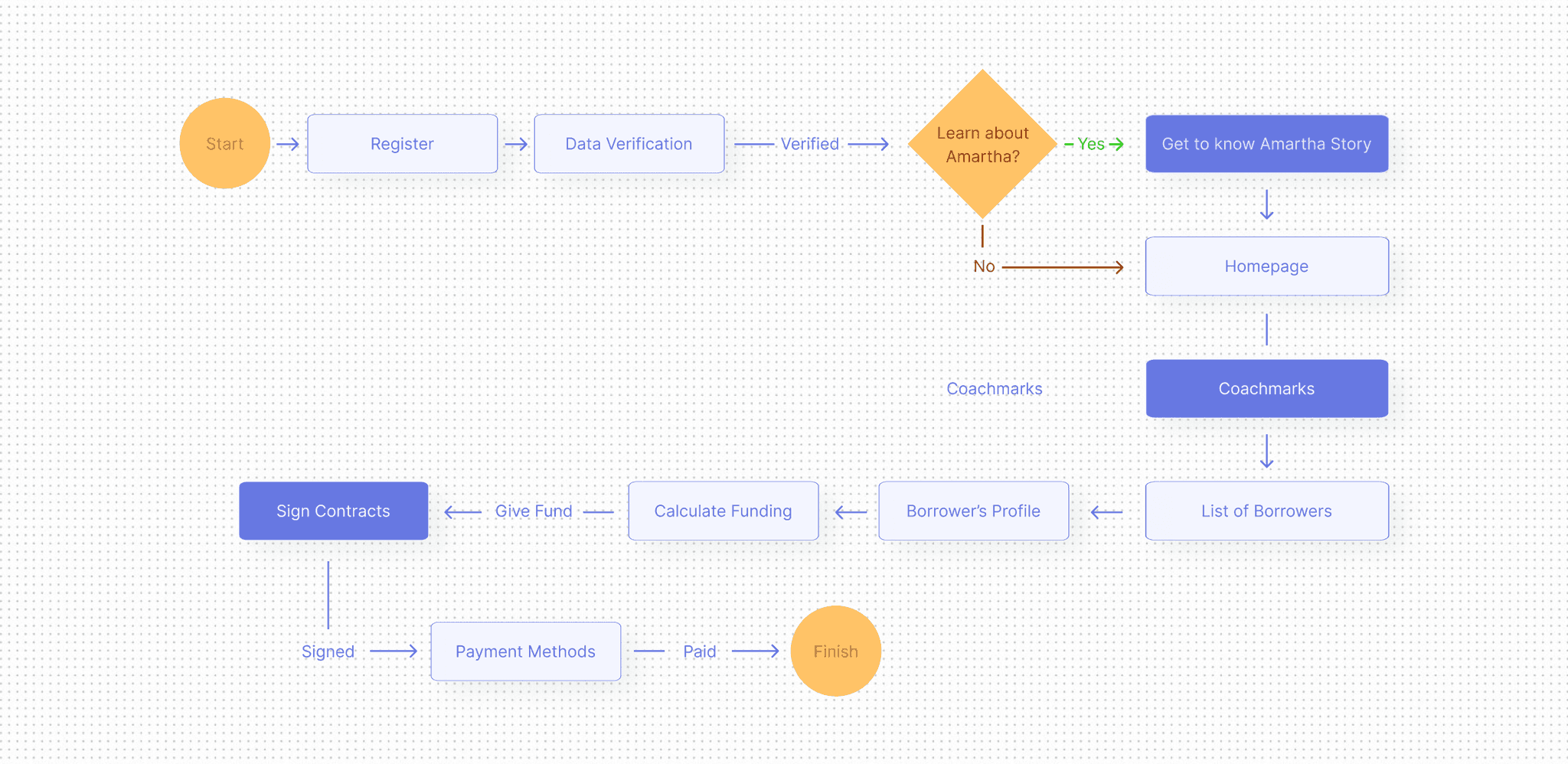

My final approach to this revamp was to optimize their whole experience with an added feature to educate new P2PL in choosing the right borrowers. This approach was based on research result and idea prioritization.

My final approach to this revamp was to optimize their whole experience with an added feature to educate new P2PL in choosing the right borrowers. This approach was based on research result and idea prioritization.

Impact Given

Impact Given

Project

🚀 83% Success Rate in usability testing

🚀 83% Success Rate in usability testing

🎨 Built design system from the ground up

🎨 Built design system from the ground up

Personal

📝 Mastered unmoderated usability testing

👩🏻🎓Graduated from my Bootcamp with this project

👩🏻🎓Graduated from my Bootcamp with this project

Context & Research

Context & Research

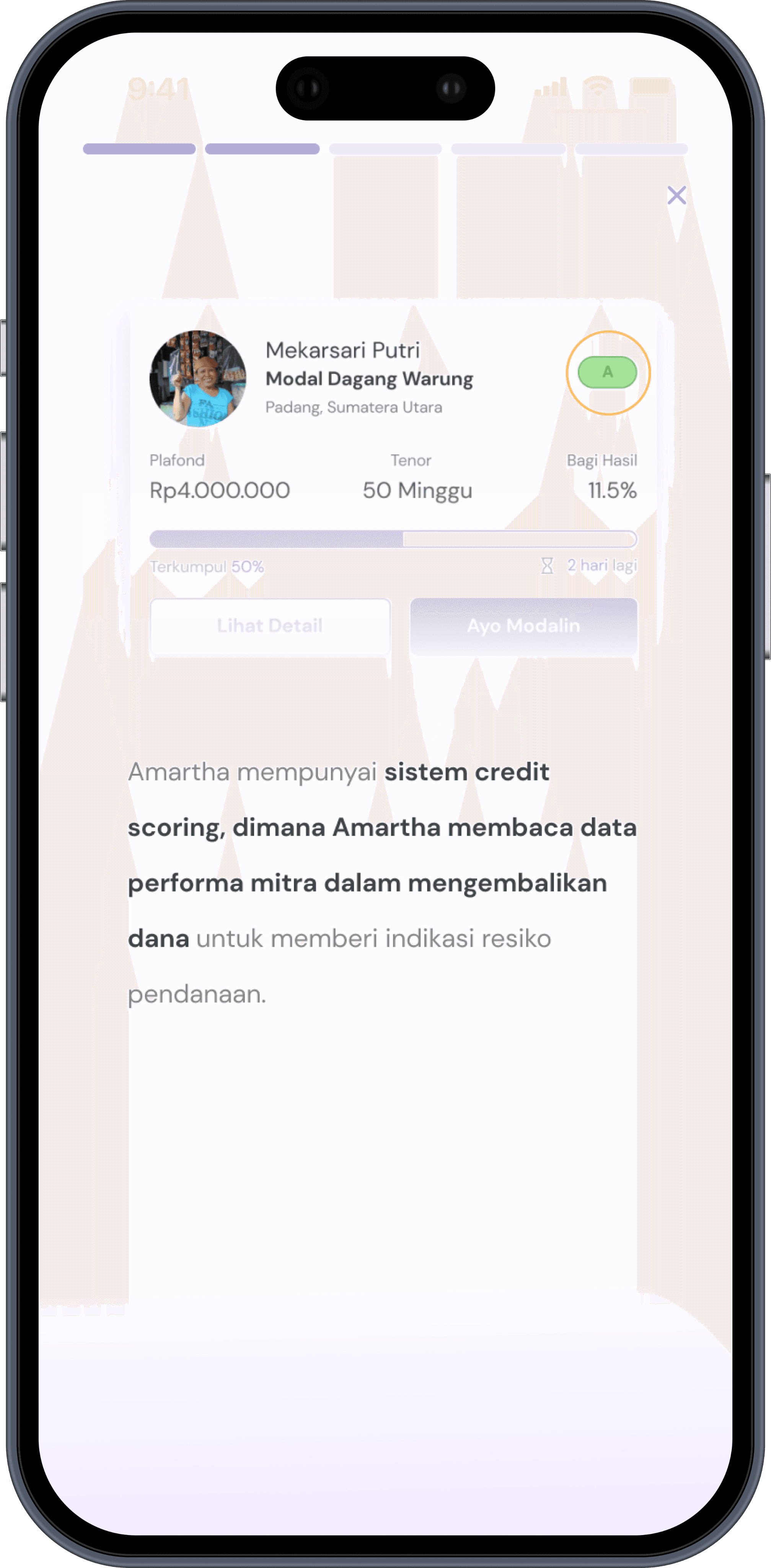

I did user interviews and usability testing to gather contexts. As it turns out, investment is not some rocket science anymore for new Amartha users but they still experience problem using the app, especially their vague credit-scoring system.

I did user interviews and usability testing to gather contexts. As it turns out, investment is not some rocket science anymore for new Amartha users but they still experience problem using the app, especially their vague credit-scoring system.

I did user interviews and usability testing to gather contexts. As it turns out, investment is not some rocket science anymore for new Amartha users but they still experience problem using the app, especially their vague credit-scoring system.

"I'm active in Mutual Fund/Stock market, I only use Peer-to-Peer (P2P) Lending mainly for diversification"

"I'm active in Mutual Fund/Stock market, I only use Peer-to-Peer (P2P) Lending mainly for diversification"

— Insights from User Interviews

— Insights from User Interviews

"How can this borrower's profile got an A credit score? What does it stand for? Why does she get an A but the one with bigger profits gets a B?"

"How can this borrower's profile got an A credit score? What does it stand for? Why does she get an A but the one with bigger profits gets a B?"

— Insights from Usability Testing

— Insights from Usability Testing

From all the research methods, I was able to identify the following contexts

From all the research methods, I was able to identify the following contexts

Users are experienced investors & uses P2P Lending for the low risk = high return

Users are experienced investors & uses P2P Lending for the low risk = high return

Users are experienced investors & uses P2P Lending for the low risk = high return

Determining profit is still difficult despite the credit scoring in Amartha

Determining profit is still difficult despite the credit scoring in Amartha

Determining profit is still difficult despite the credit scoring in Amartha

Marketplace Experience perceived as spending instead of investing

Marketplace Experience perceived as spending instead of investing

Marketplace Experience perceived as spending instead of investing

More information about credit scoring & proof of OJK-supervision need to be shown more

More information about credit scoring & proof of OJK-supervision need to be shown more

More information about credit scoring & proof of OJK-supervision need to be shown more

Which brings my core challenge in this revamp project:

Which brings my core challenge in this revamp project:

How Might We help educate new P2P Lending investors

in optimally funding SMEs in Amartha App?

How Might We help educate new P2P Lending investors in optimally funding SMEs in Amartha App?

How Might We help educate new P2P Lending investors

in optimally funding SMEs in Amartha App?

Jump to Solution

Opportunities in The Experience

Opportunities in The Experience

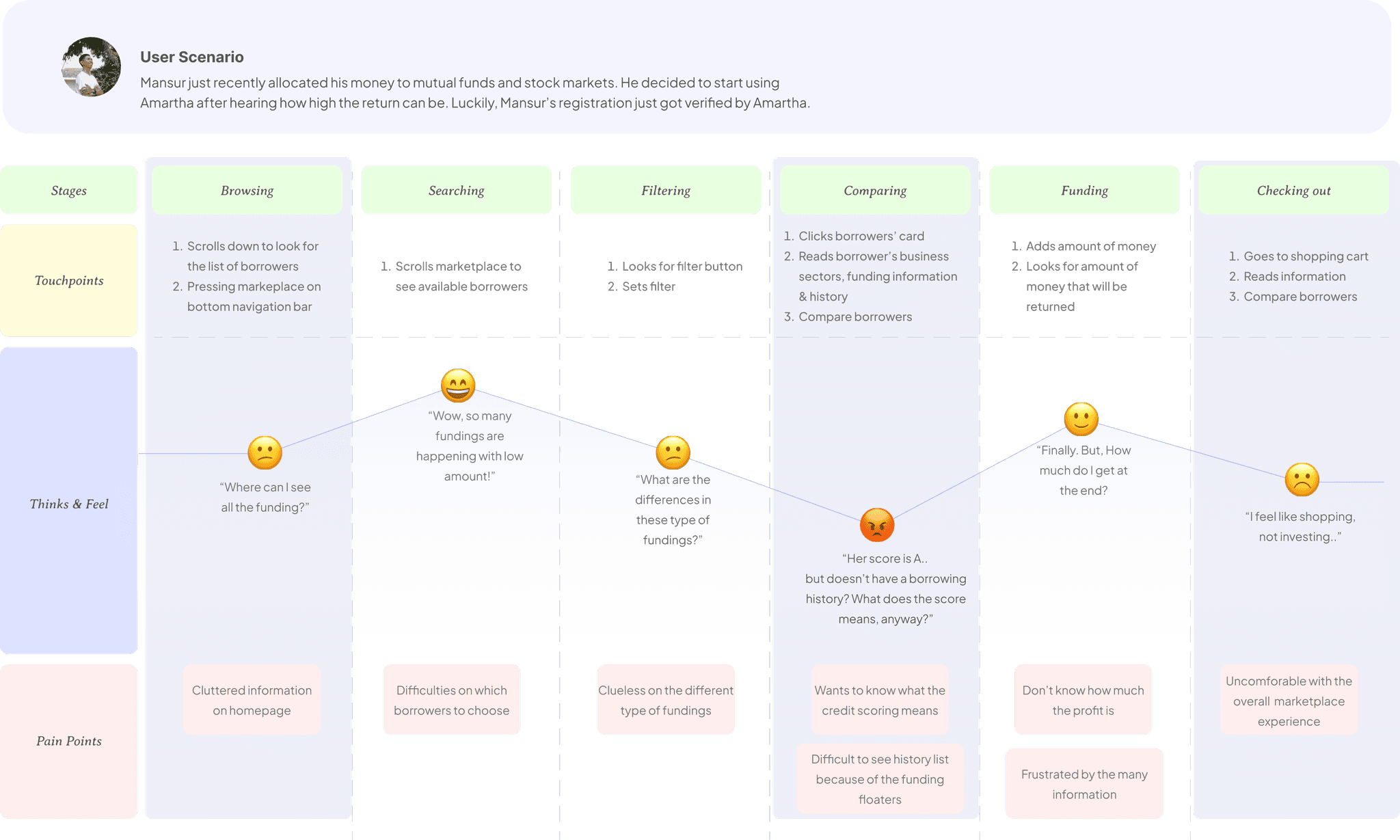

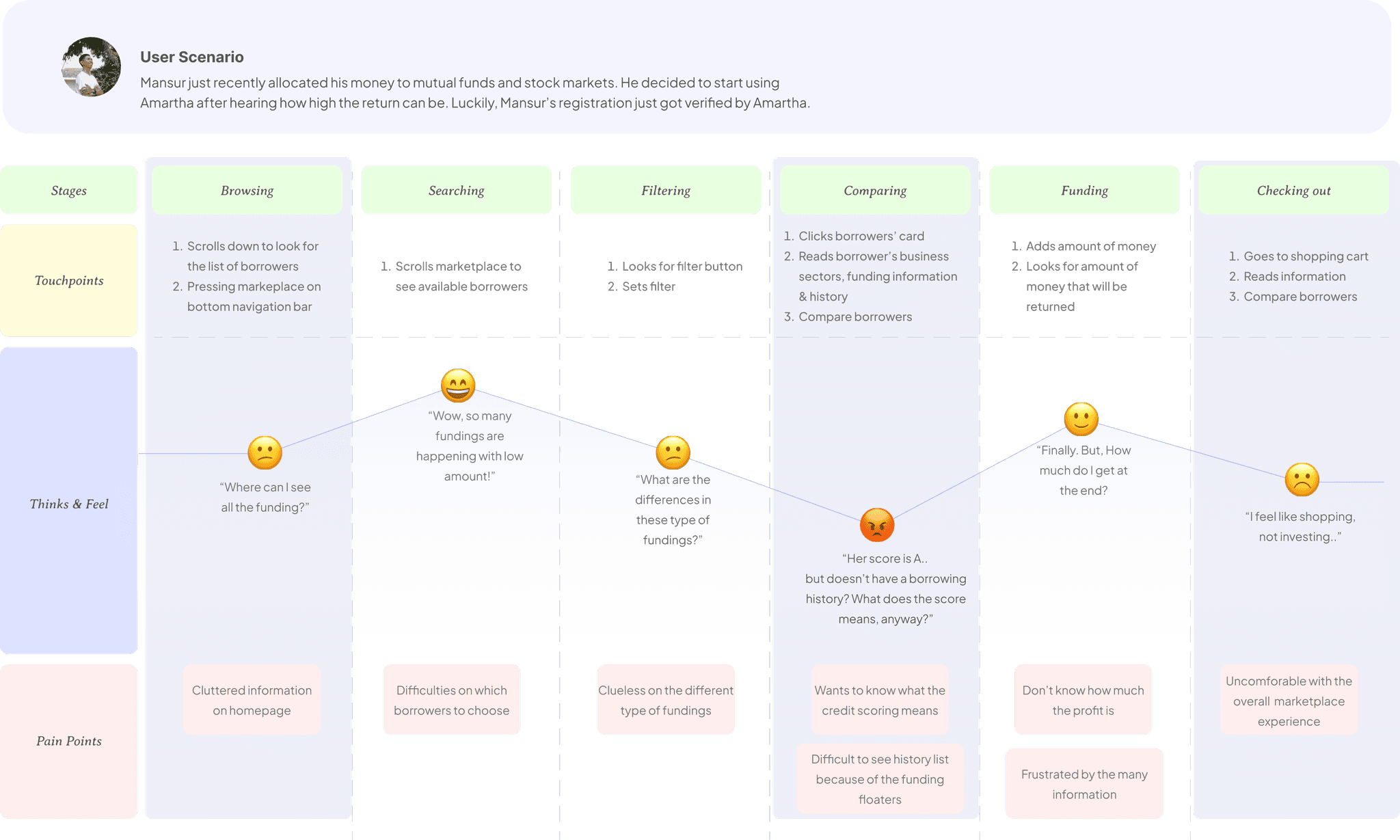

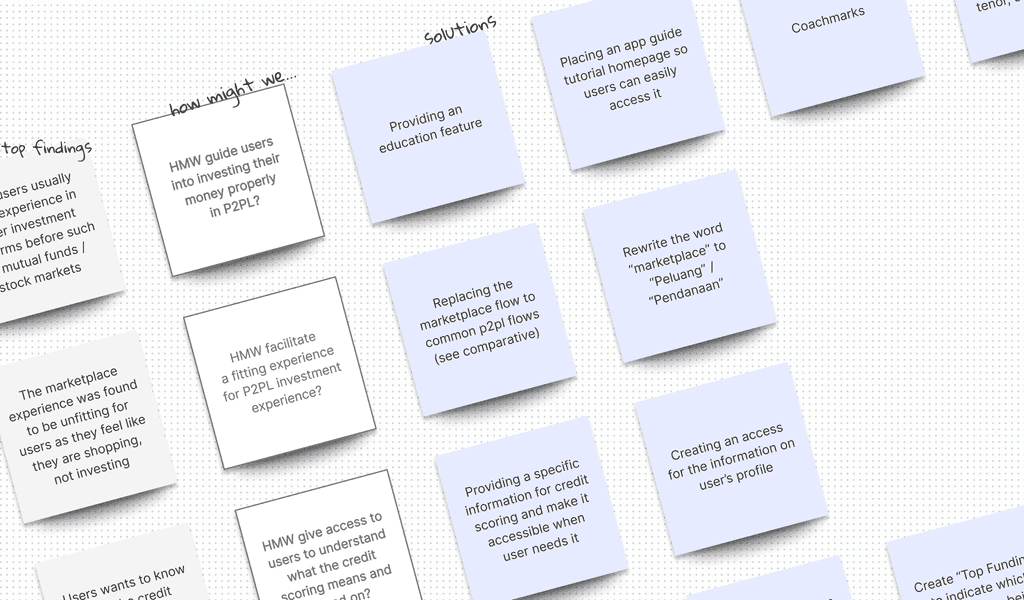

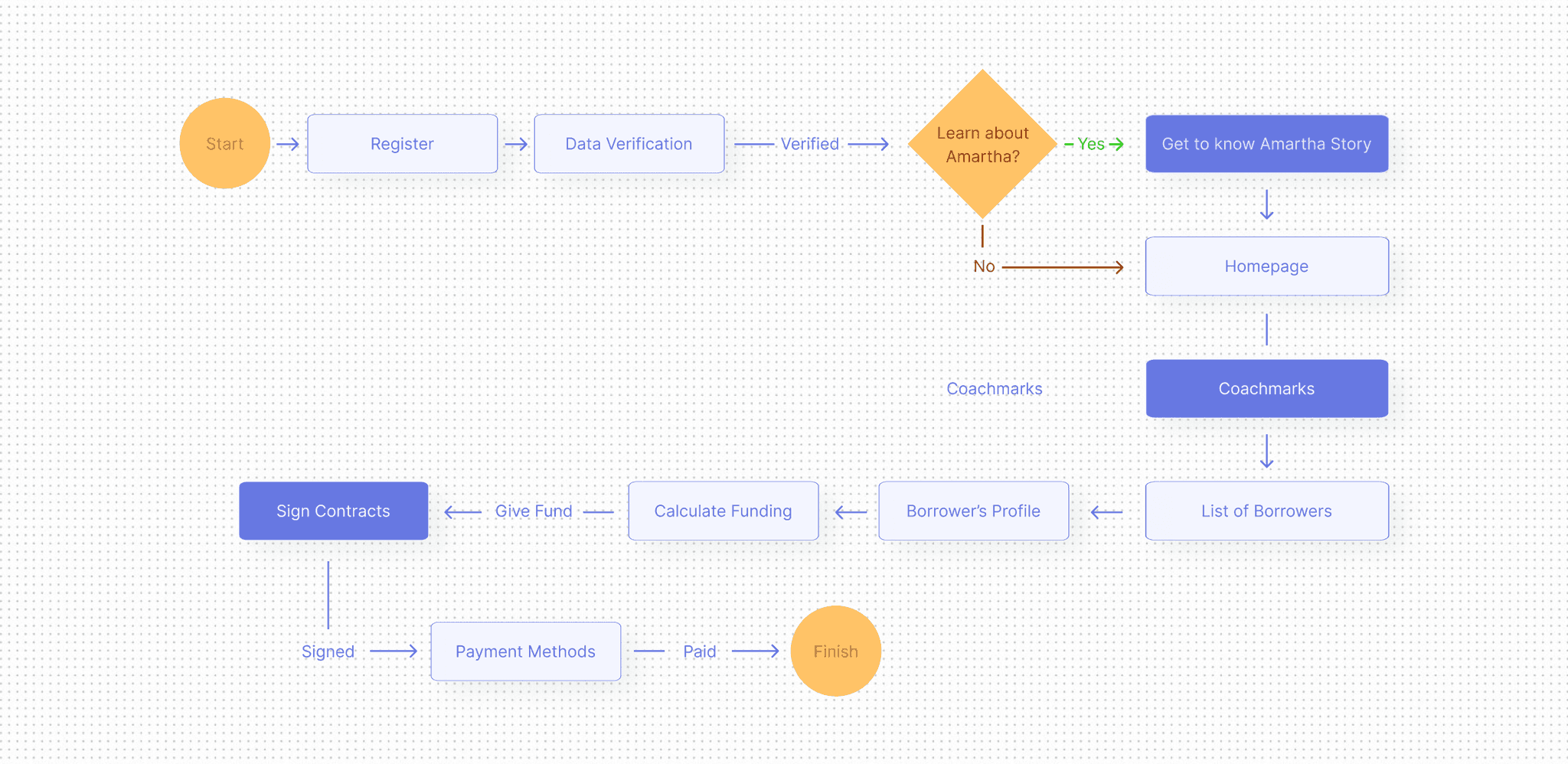

I created a user journey map to identify where frustrations could most likely occur. The map revealed that browsing, comparing, and checking out are the three key areas to prioritize during brainstorming. This helped me stay focused on answering the How Might We questions later on.

I created a user journey map to identify where frustrations could most likely occur. The map revealed that browsing, comparing, and checking out are the three key areas to prioritize during brainstorming. This helped me stay focused on answering the How Might We questions later on.

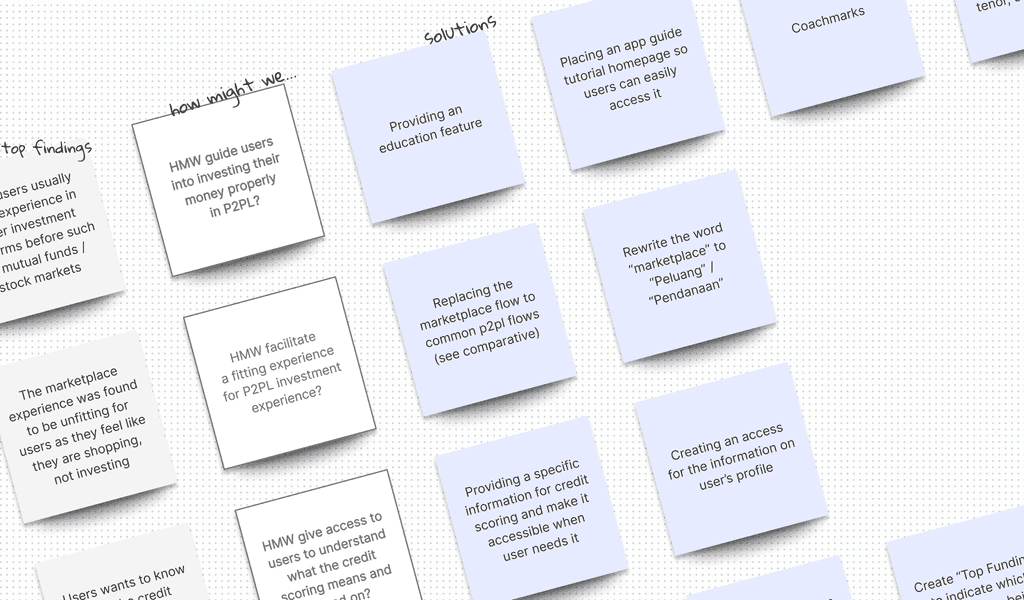

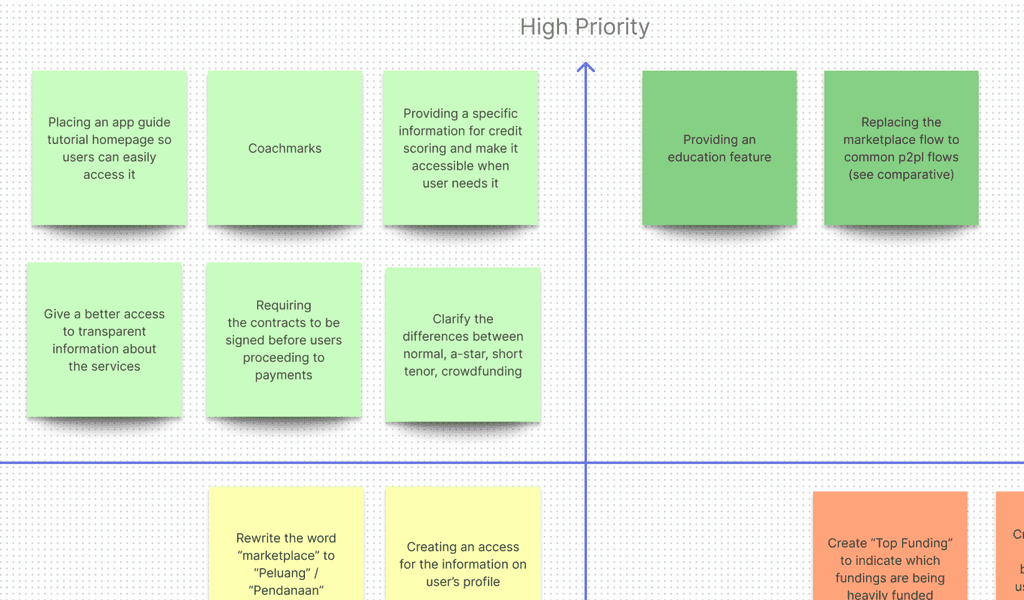

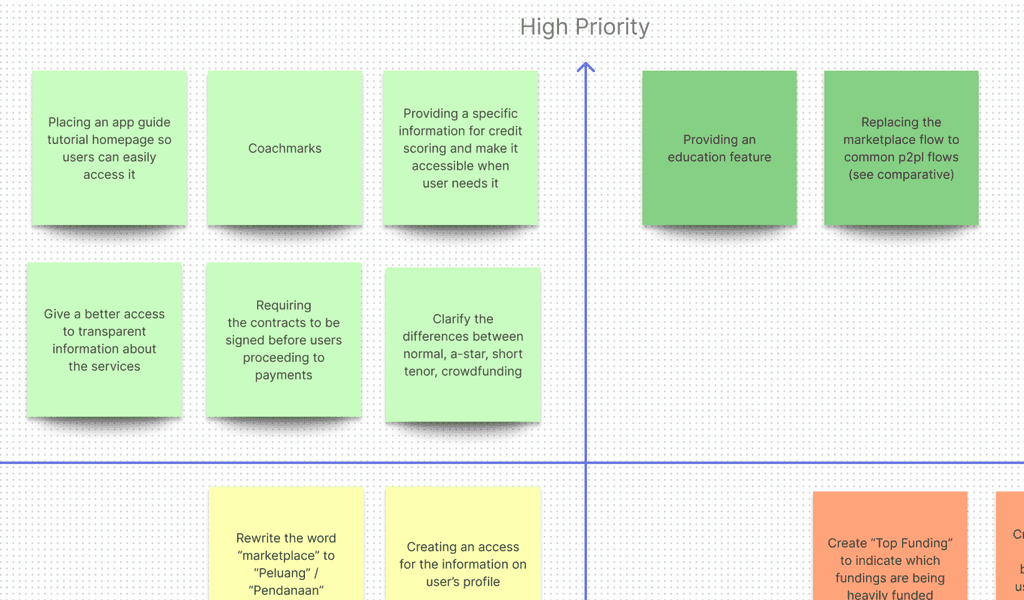

From there, I began my most creative process. From diverging ideas using How Might We, to converging ideas through Priority Matrix (Priority x Impact)

From there, I began my most creative process. From diverging ideas using How Might We, to converging ideas through Priority Matrix (Priority x Impact)

The Solution

The Solution

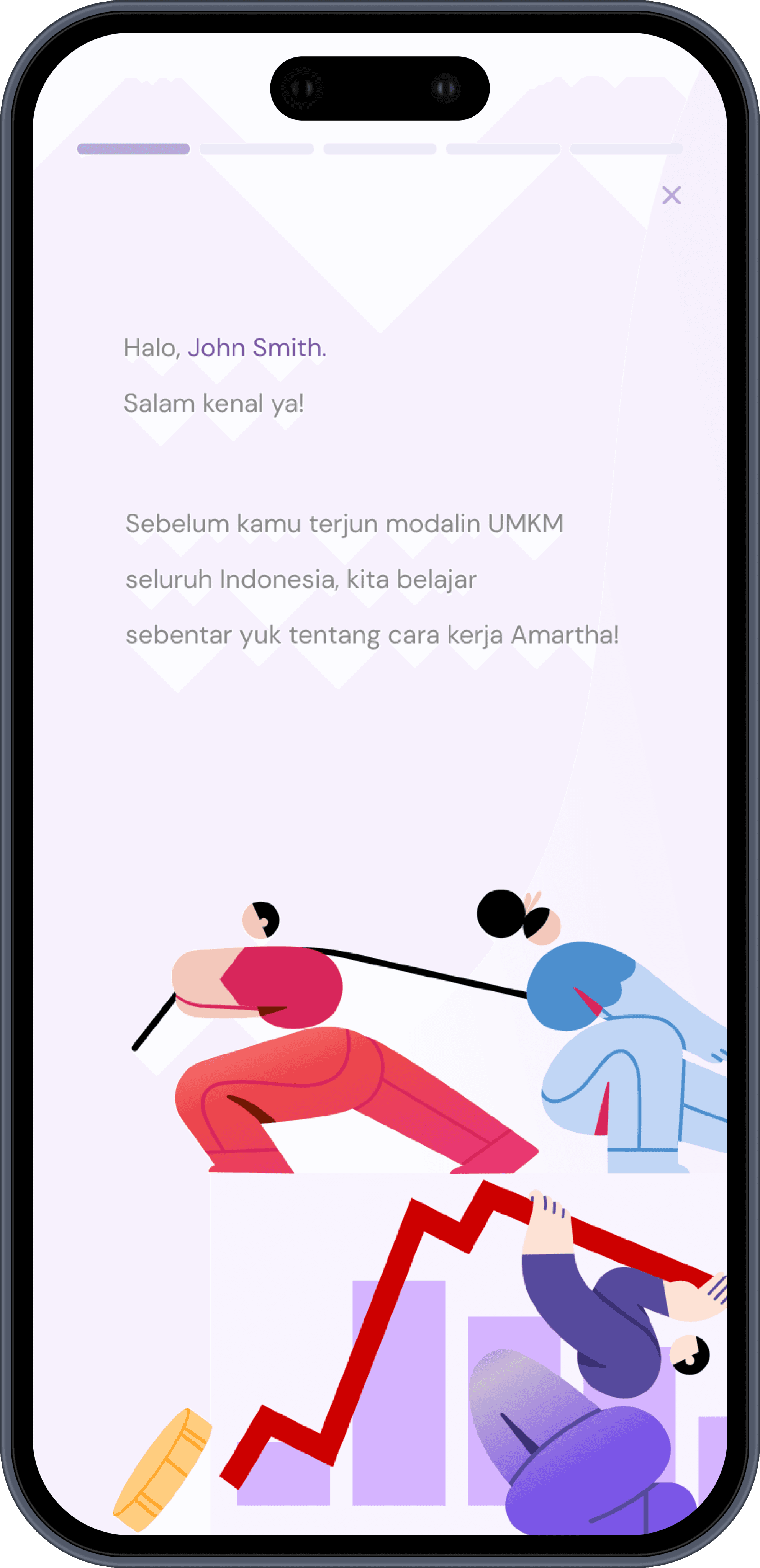

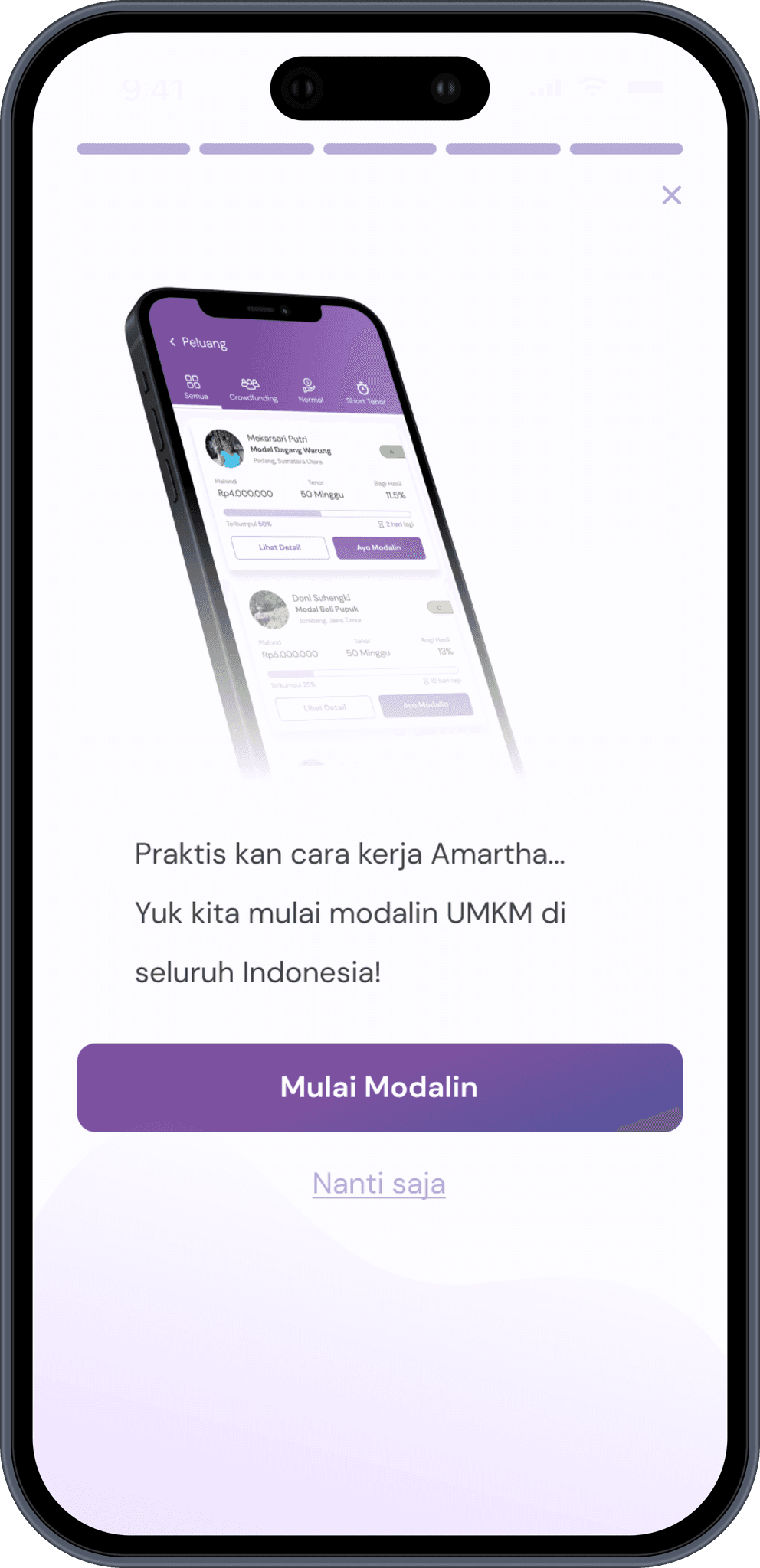

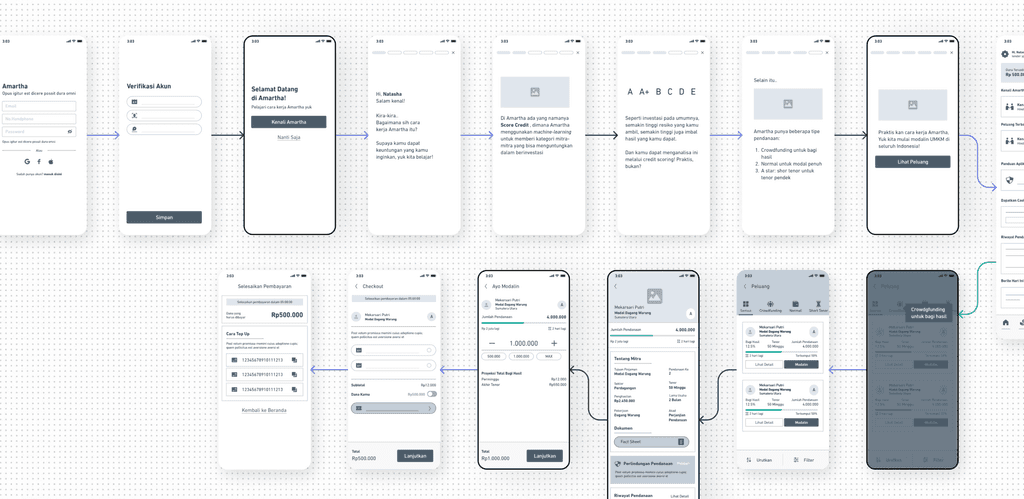

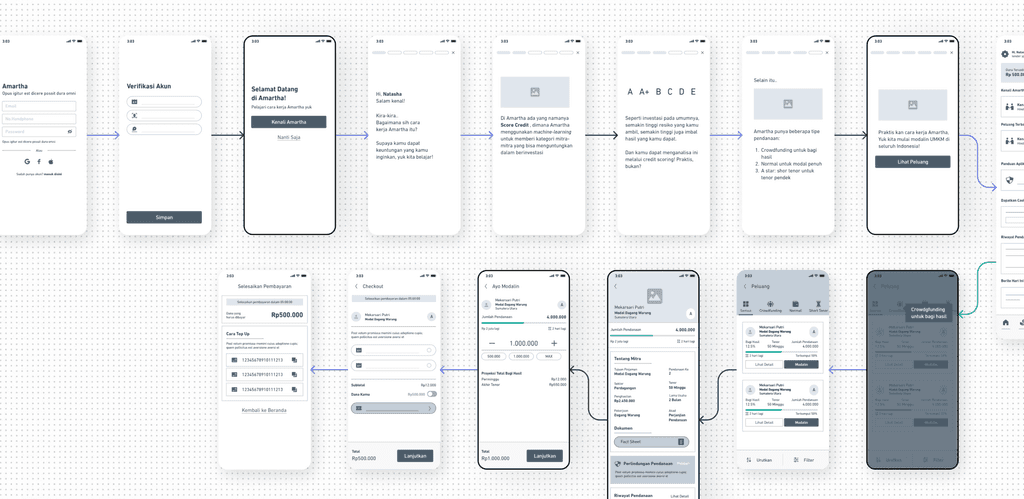

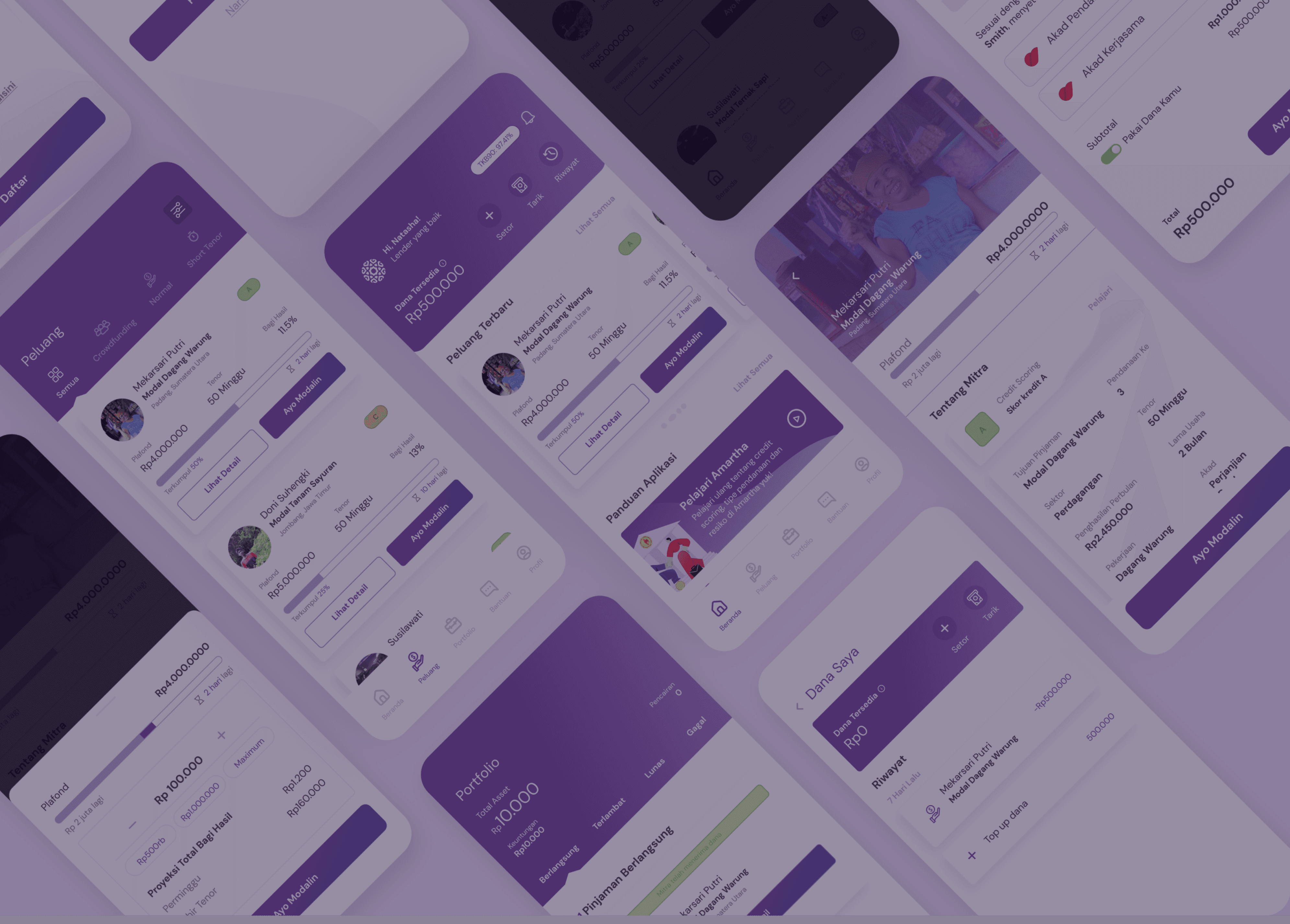

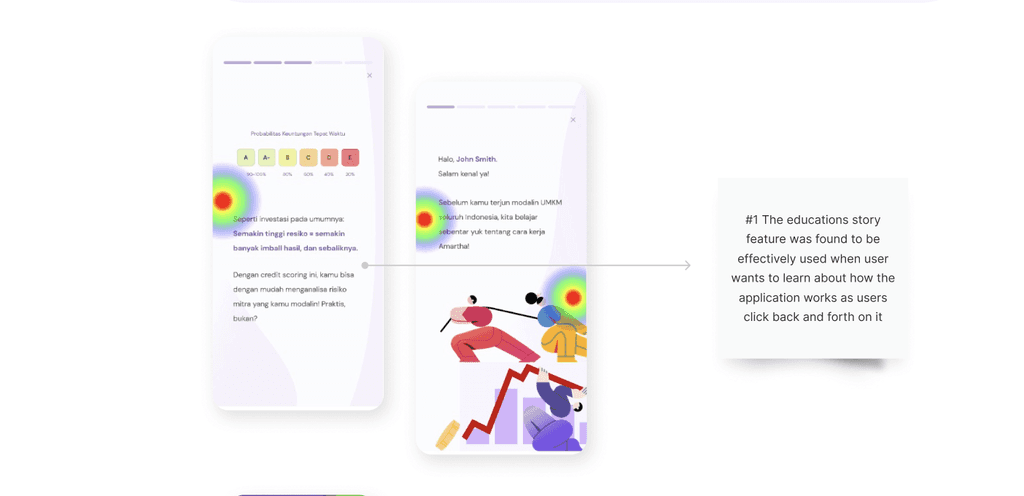

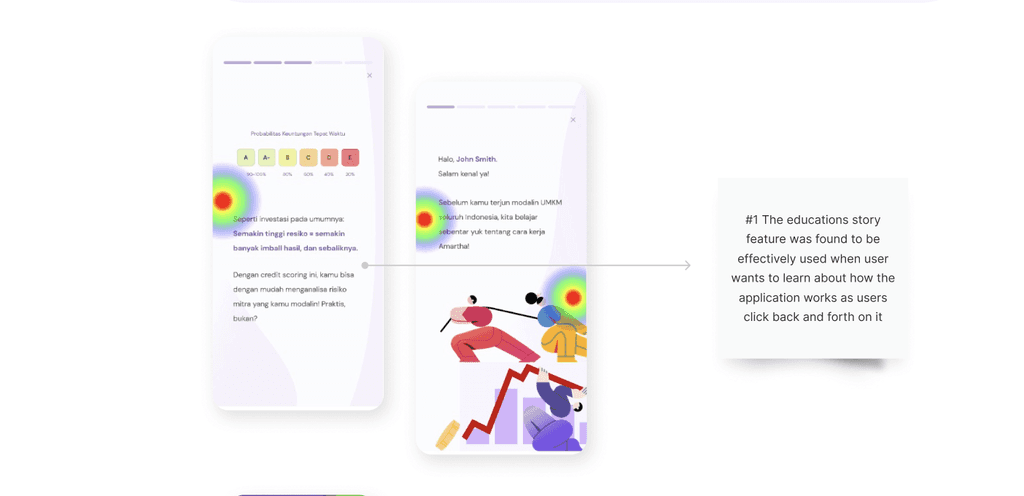

Educative Onboarding

An educative onboarding is introduced upon registration. This feature provides essential information about Amartha’s borrower profiles, credit scoring system, and different types of lending.

By integrating this feature, I aimed to bridge the knowledge gap for first-time investors.

An educative onboarding is introduced upon registration. This feature provides essential information about Amartha’s borrower profiles, credit scoring system, and different types of lending. By integrating this feature, I aimed to bridge the knowledge gap for first-time investors.

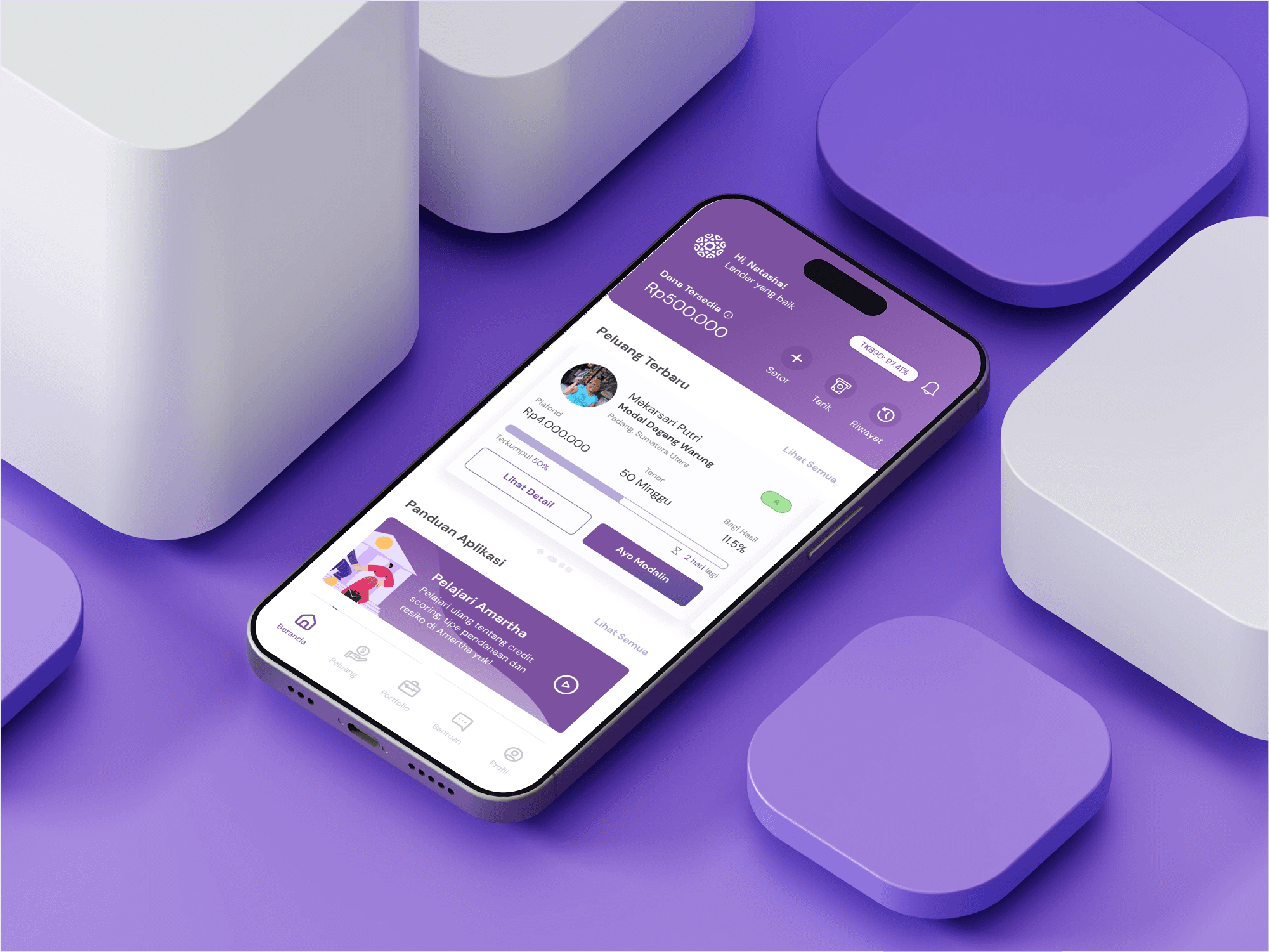

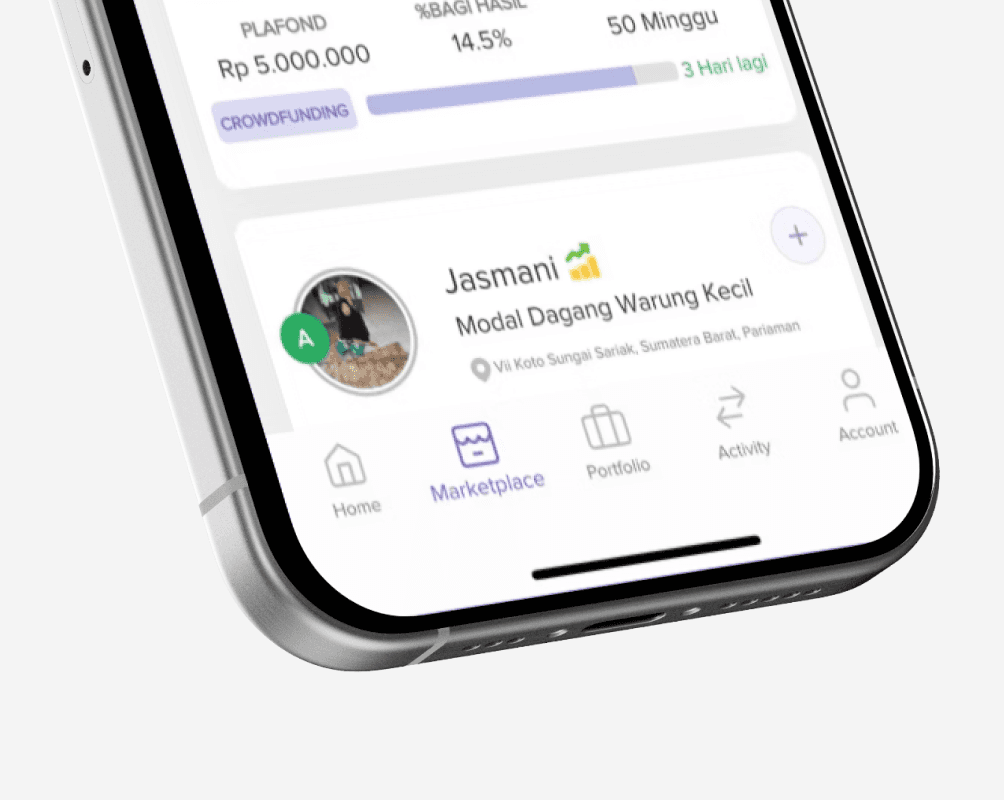

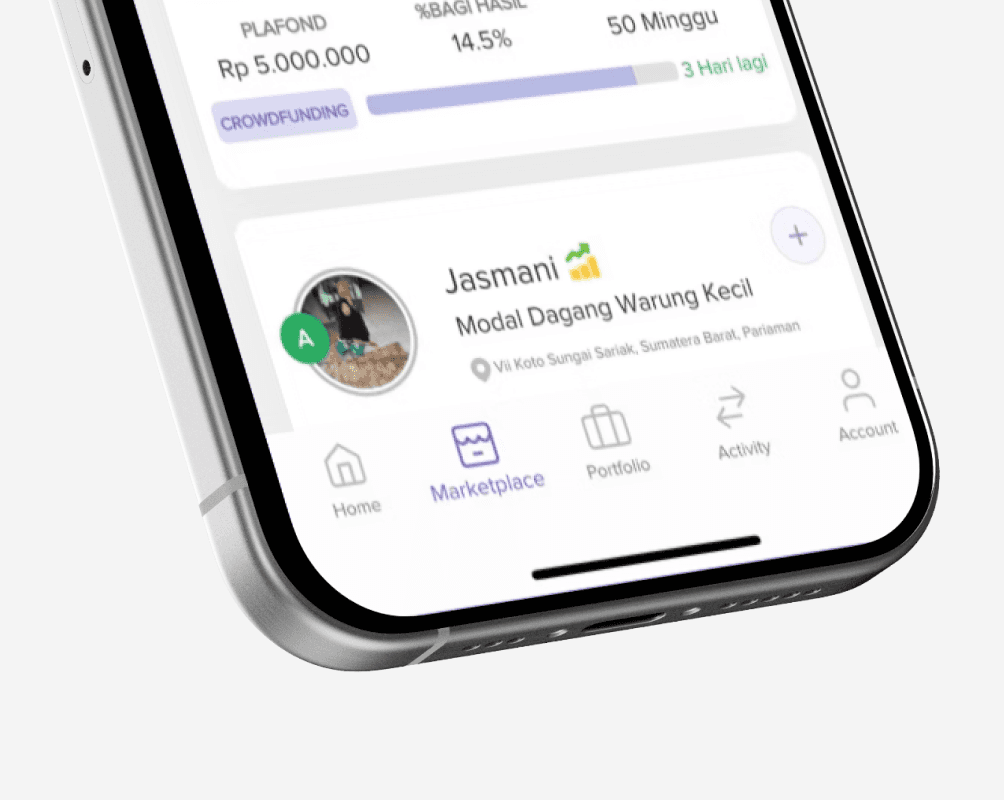

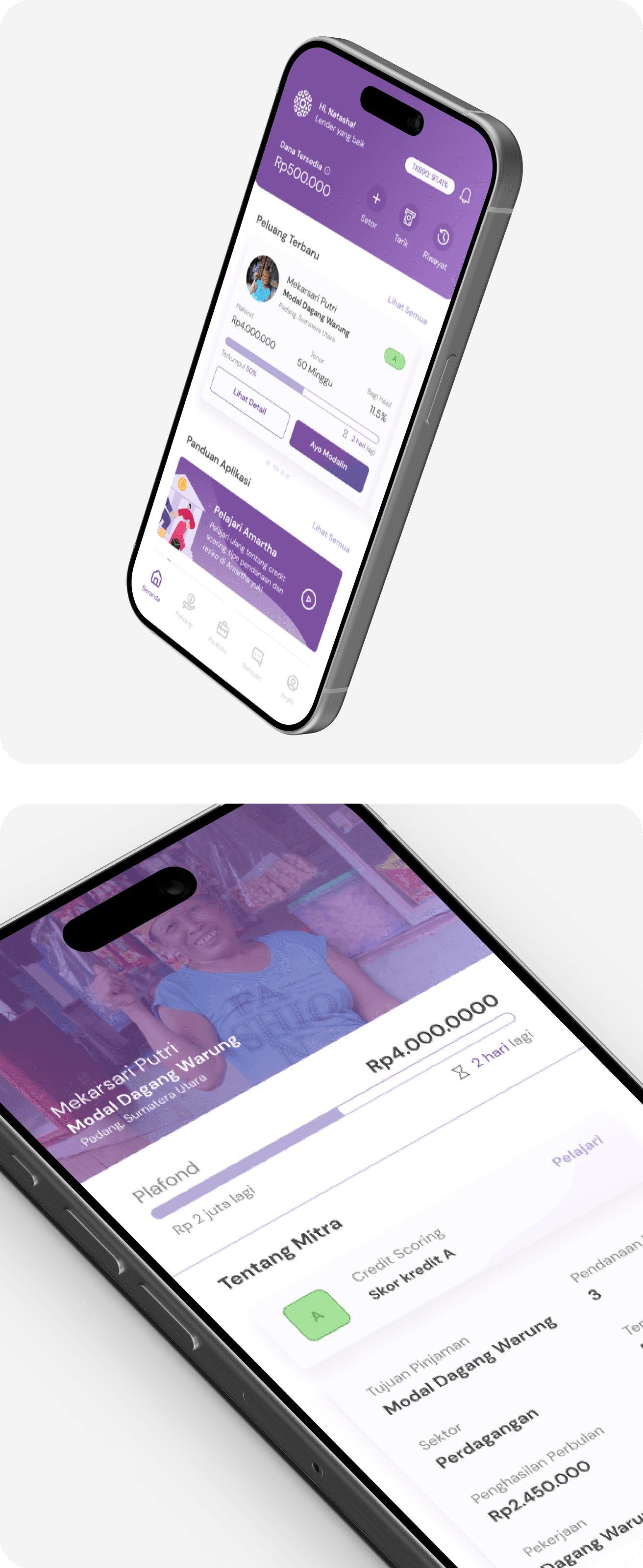

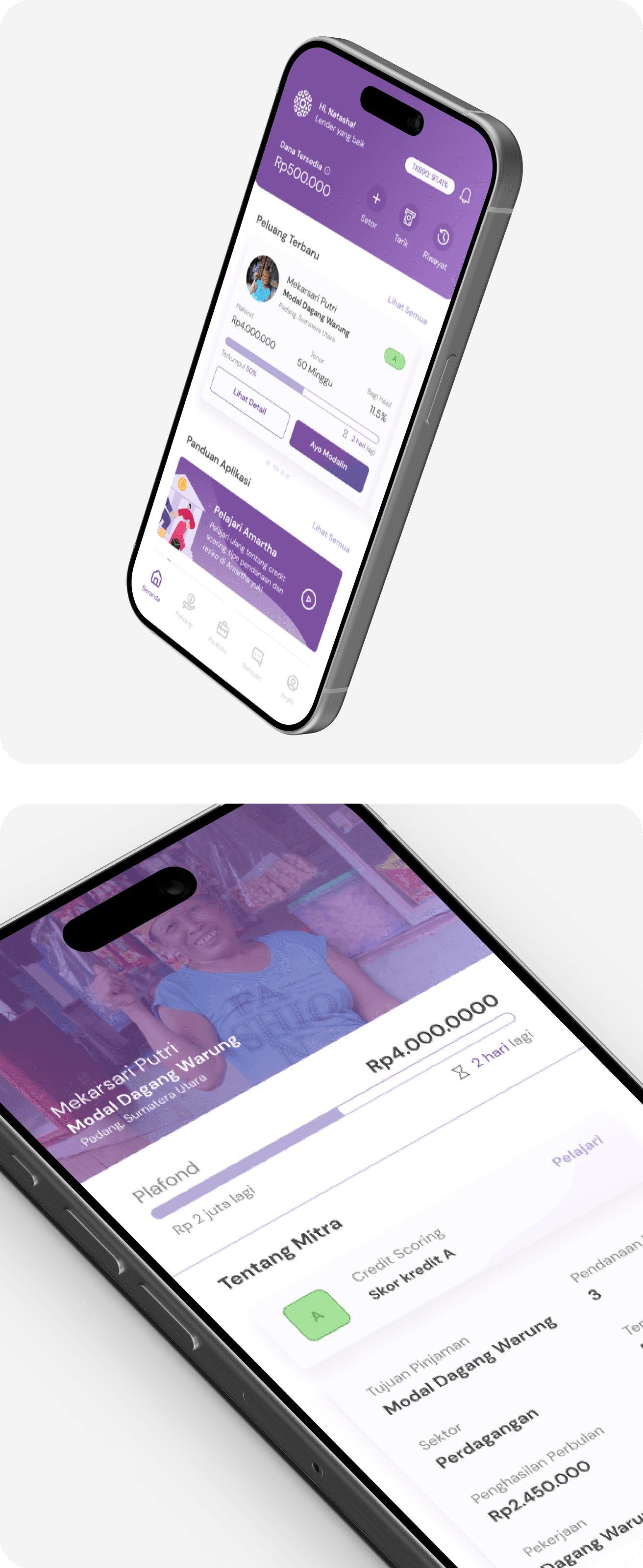

Dashboard's New Look

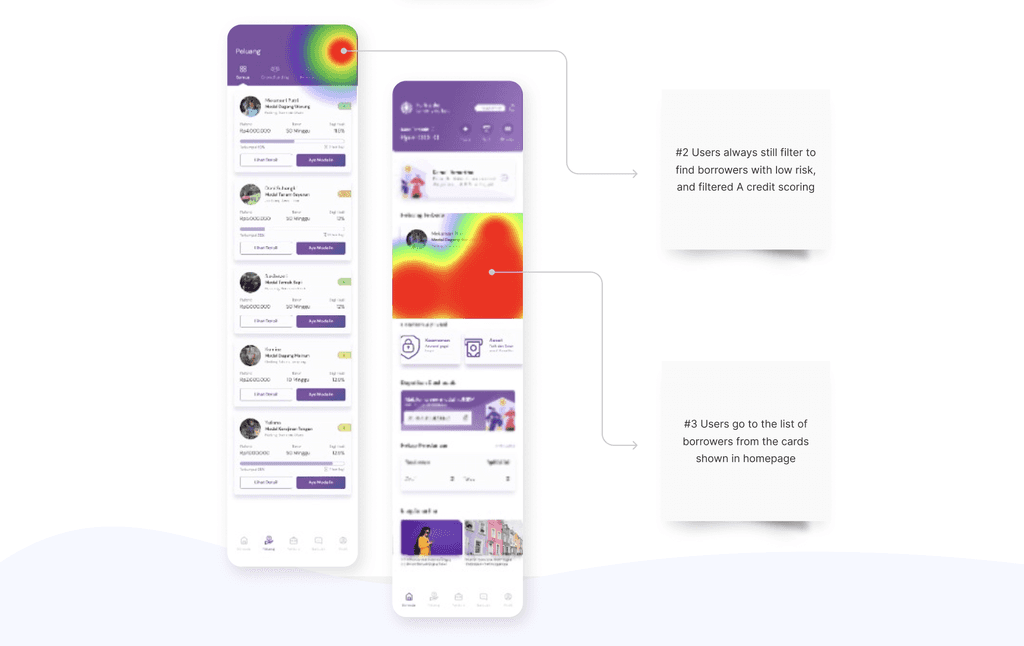

The dashboard is redesigned to improve accessibility and visibility, making it easier for users to navigate the app. One of the key improvement was the borrower preview section, allowing investors to quickly glance at available lending opportunities and seamlessly access the full borrower list.

The dashboard is redesigned to improve accessibility and visibility, making it easier for users to navigate the app. One of the key improvement was the borrower preview section, allowing investors to quickly glance at available lending opportunities and seamlessly access the full borrower list.

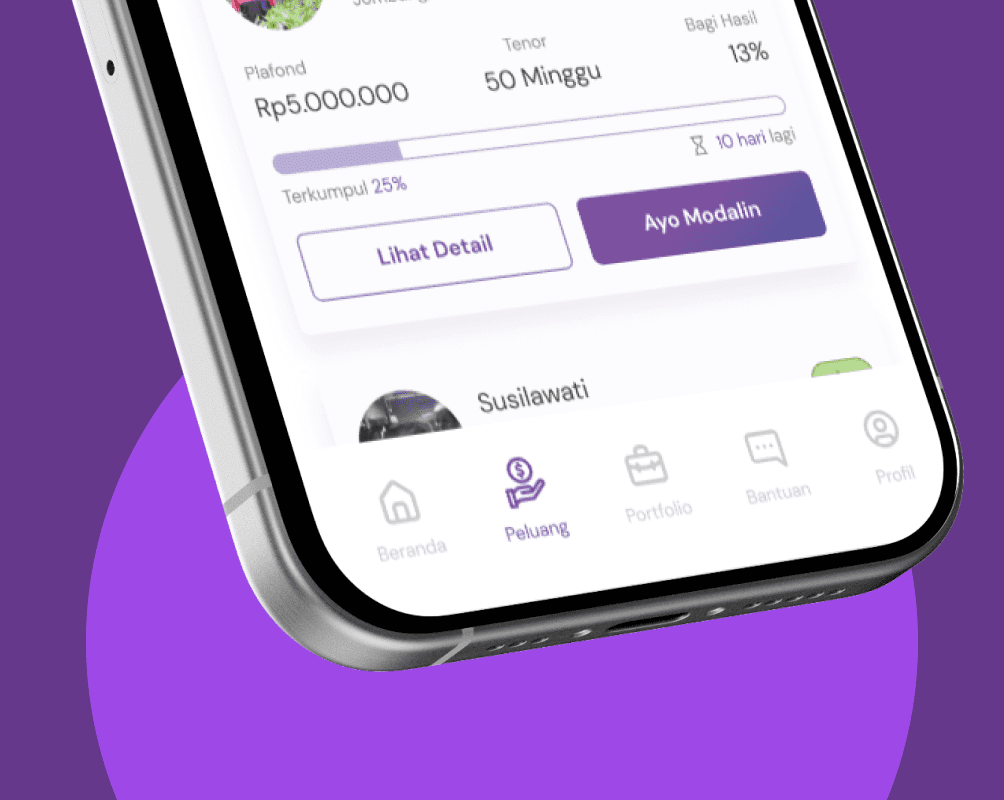

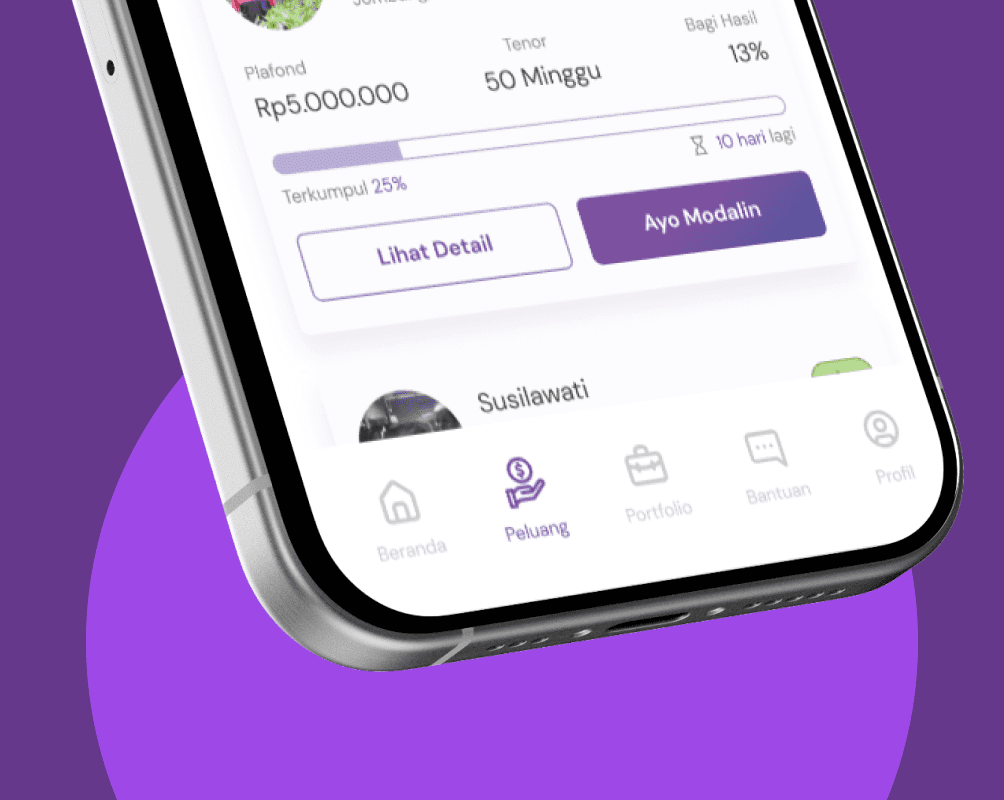

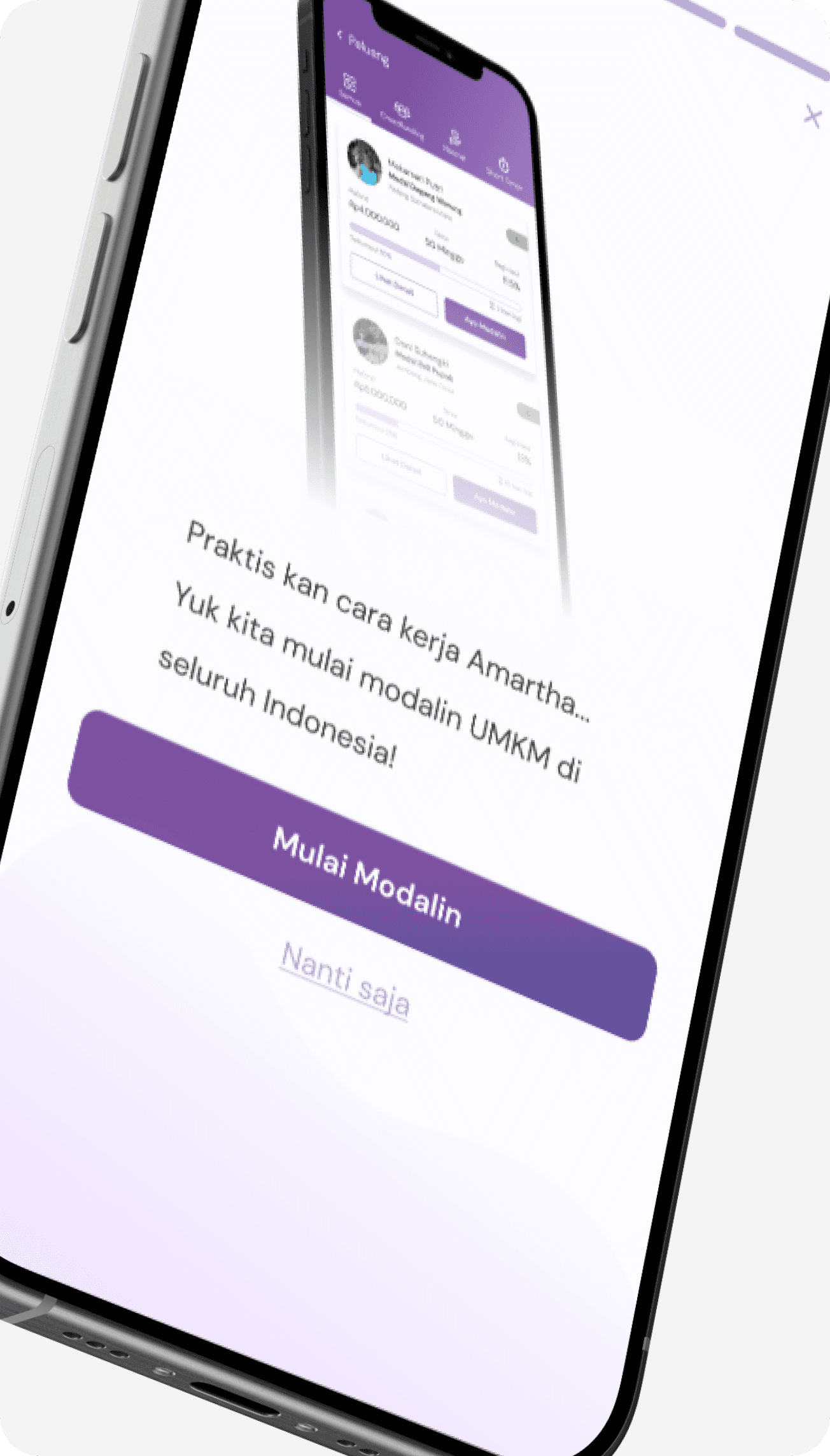

From Marketplace to Peluang

I revamped the copywriting from "Marketplace" to "Peluang" (which means Opportunity) due to many insights that "Marketplace" made investing feel like shopping. By renaming it to "Peluang," the app now conveys a investment-oriented representation while also reinforcing the idea that users are seizing opportunities rather than simply purchasing.

I revamped the copywriting from "Marketplace" to "Peluang" (which means Opportunity) due to many insights that "Marketplace" made investing feel like shopping. By renaming it to "Peluang," the app now conveys a investment-oriented representation while also reinforcing the idea that users are seizing opportunities rather than simply purchasing.

Screen Gallery

Screen Gallery

Aa

Aa

Aa

DM Sans

DM Sans

DM Sans

Regular, Bold

Regular, Bold

Regular, Bold

Title

Title

Title

Regular & Bold, 24px

Regular & Bold, 24px

Regular & Bold, 24px

Headline

Headline

Headline

Regular & Bold, 20px

Regular & Bold, 20px

Regular & Bold, 20px

Subheadline

Subheadline

Subheadline

Regular & Bold, 16px

Regular & Bold, 16px

Regular & Bold, 16px

Body Text 1

Body Text 1

Body Text 1

Regular & Bold, 14px

Regular & Bold, 14px

Regular & Bold, 14px

Body Text 2

Body Text 2

Body Text 2

Regular & Bold, 12px

Regular & Bold, 12px

Regular & Bold, 12px

Body Text 3

Body Text 3

Body Text 3

Regular & Bold, 10px

Regular & Bold, 10px

Regular & Bold, 10px

#7C51A0

#7C51A0

#7C51A0

#444444

#444444

#444444

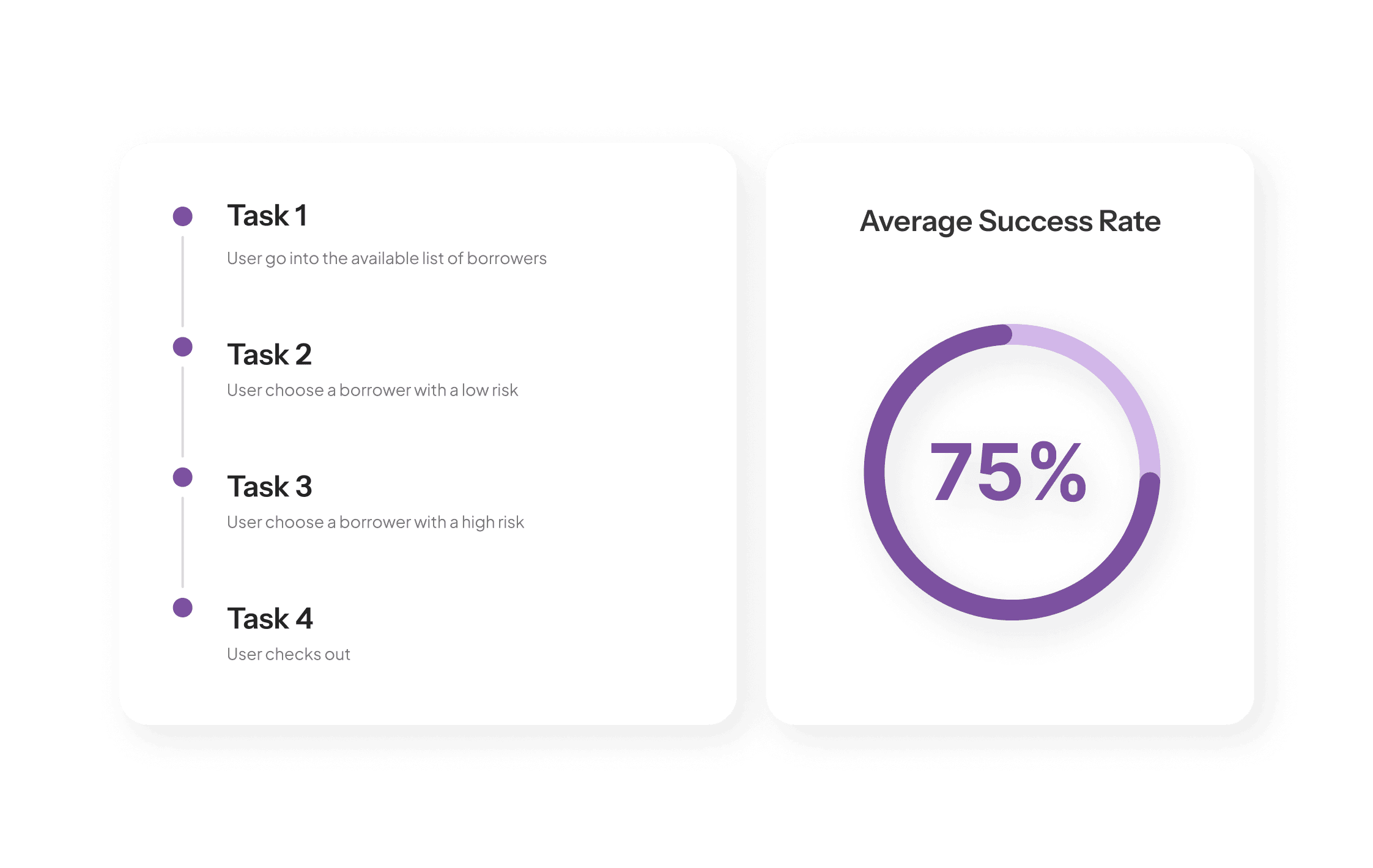

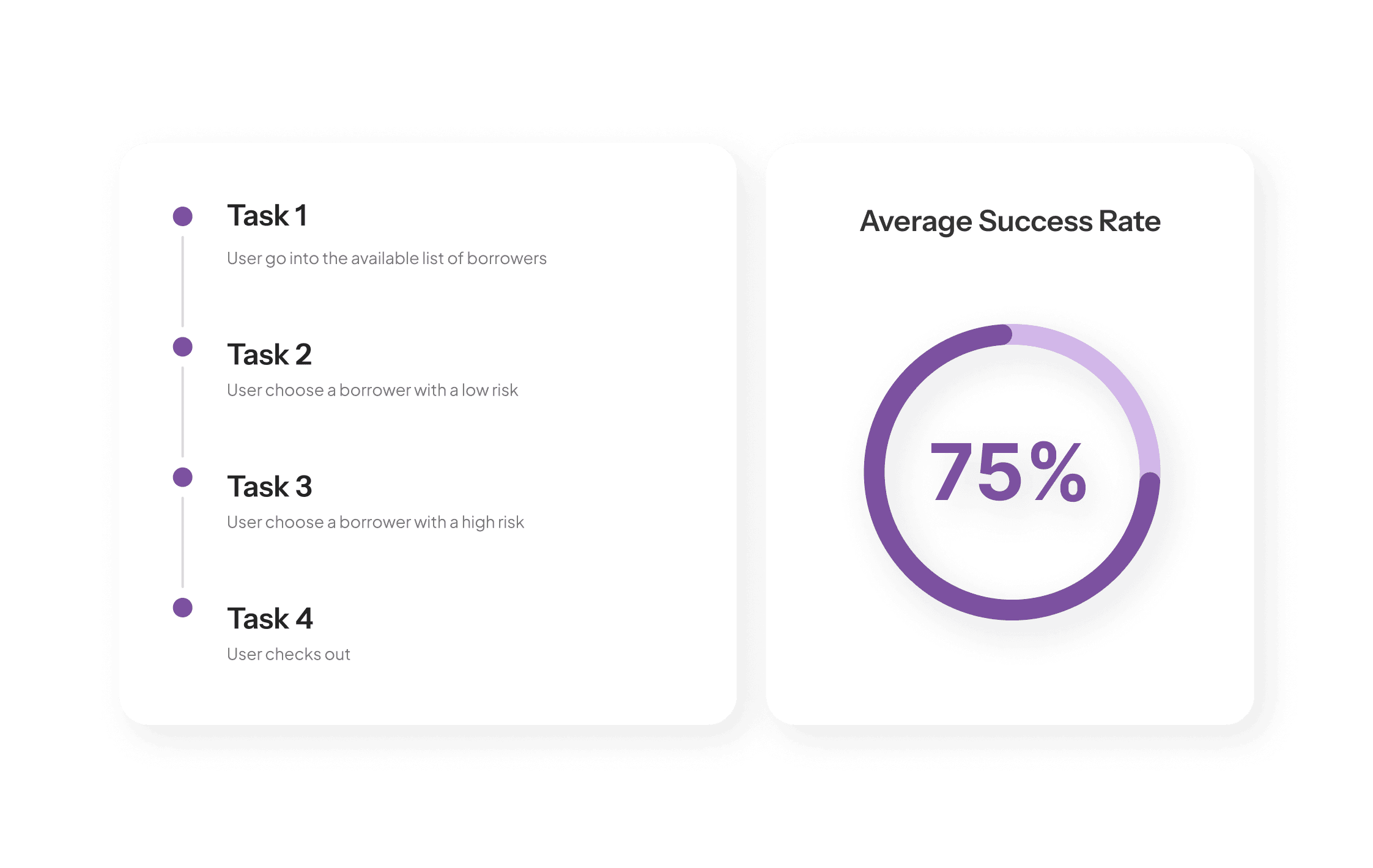

Impact

6 Users

6 Users

Users actively using & has ever used P2PL investment and Users who has never used P2PL

Users actively using & has ever used P2PL investment and Users who has never used P2PL

Unmoderated

Unmoderated

via Maze

via Maze

Task 1

Task 1

Login & Get to know Amartha

Login & Get to know Amartha

Task 2

Task 2

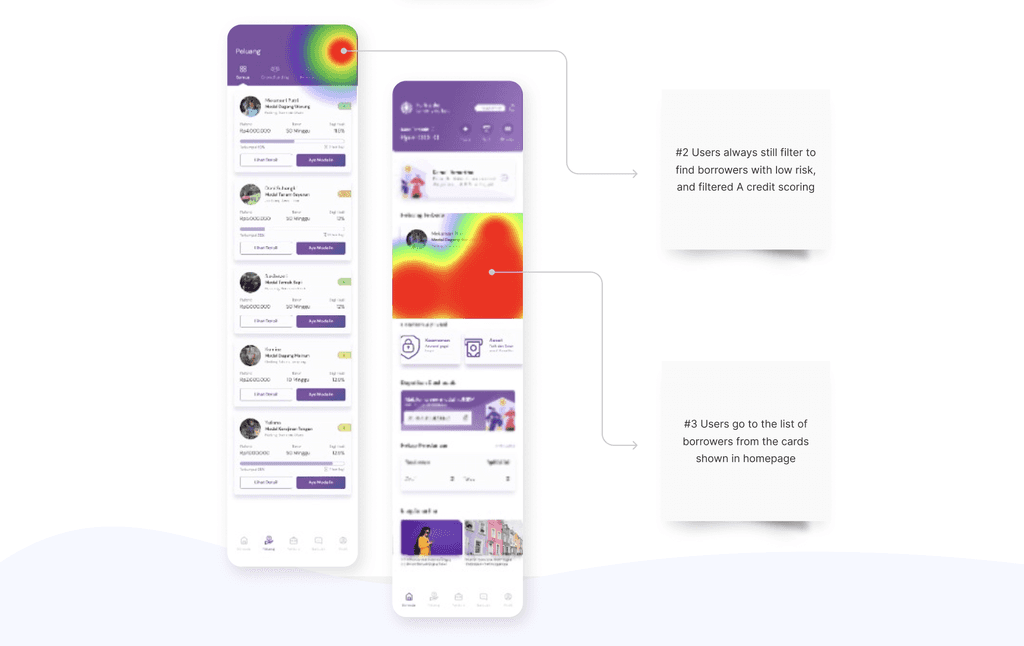

Go to list of borrowers and choose crowdfunding

with a low risk using a filter

Go to list of borrowers and choose crowdfunding

with a low risk using a filter

Task 3

Task 3

See borrower’s funding history

See borrower’s funding history

Task 4

Task 4

Lend 1.000.000 to the borrower & sign contract

Lend 1.000.000 to the borrower & sign contract

Average Success Rate

Average

Success

Rate

Learnings

Learnings

Looking Back

Looking Back

I would gather more Amartha app users and conduct a moderated user testing. That way, the design process would be more efficient.

I would gather more Amartha app users and conduct a moderated user testing. That way, the design process would be more efficient.

Looking Forward

Looking Forward

I would focus on the problem even more, and make sure to minise technical error in Maze

I would focus on the problem even more, and make sure to minise technical error in Maze